If you recently lost your job or had your hours reduced in California, you may be eligible for unemployment insurance (UI) benefits.

The California Employment Development Department (EDD) manages this program to provide temporary income support while you search for new work.

Knowing how to calculate your unemployment benefits helps you plan your budget and ensure you receive the correct amount each week.

How Does California Unemployment Work?

Unemployment benefits replace part of your lost wages when you become unemployed through no fault of your own.

To qualify, you must have earned enough wages during your base period, be able and available to work, and actively seek employment. The EDD reviews your earnings to determine how much you’ll receive weekly and for how long.

What Is the Base Period?

Your base period is the first step in calculating unemployment. It covers the first four of the last five completed calendar quarters before you file your claim. For example,

if you file in October 2025, your base period will be from July 2024 to June 2025. EDD uses this period to calculate your highest-earning quarter, which directly affects your weekly benefit amount (WBA).

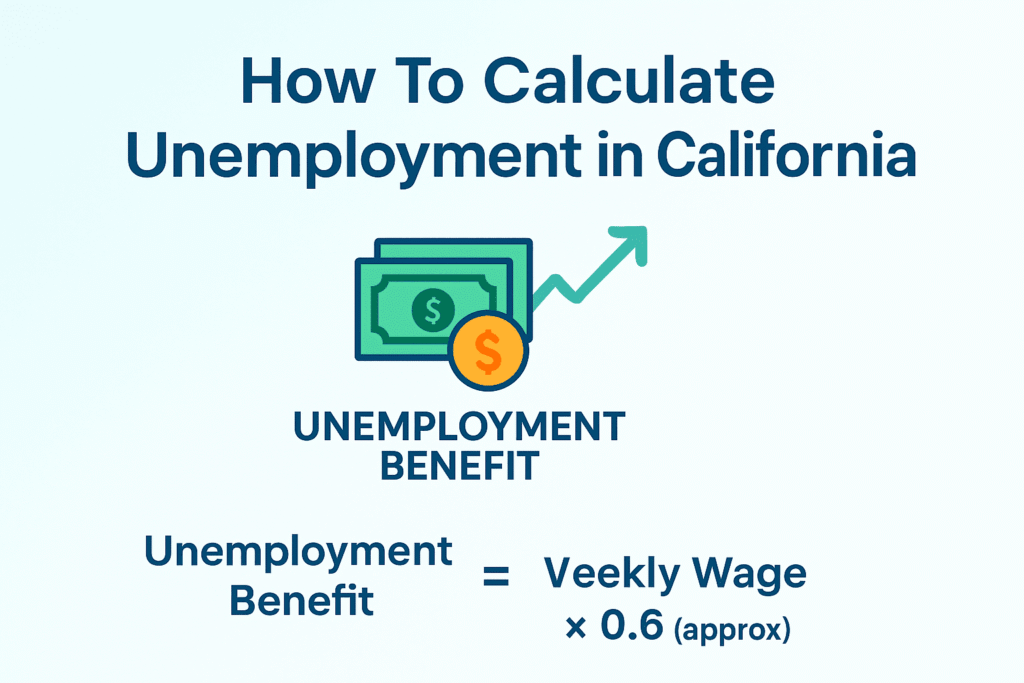

How to Calculate Your Weekly Benefit Amount (WBA)

The EDD determines your benefit amount based on your earnings in the highest quarter of your base period. The general rule is that your weekly benefit equals about 60% to 70% of your average weekly wages, up to a maximum limit.

For most workers, the benefit ranges from $40 to $450 per week in 2025.

Example Calculation

Let’s say during your highest quarter you earned $12,000. Divide this by 13 (weeks per quarter):

$12,000 ÷ 13 = $923 (average weekly wage).

Then, multiply by roughly 0.45 (EDD formula range):

$923 × 0.45 = $415.

So, your estimated weekly benefit would be $415 per week.

You can use the official EDD Benefit Calculator to check your exact benefit estimate instantly.

Maximum Duration of Benefits

Typically, California allows up to 26 weeks of unemployment benefits in a one-year benefit period. However, during periods of high unemployment or declared emergencies, federal extensions may be available to add more weeks.

Partial Unemployment Benefits

If you’re working part-time or your hours were cut, you may still qualify for partial unemployment. EDD subtracts part of your weekly earnings from your full WBA, ensuring you still get support while maintaining part-time work.

For instance, if your weekly benefit is $400 and you earn $100 from a part-time job, EDD may reduce your payment to around $350. This encourages people to keep working while still getting help.

Eligibility Requirements

To continue receiving unemployment payments, you must:

- File weekly or biweekly claims confirming you’re still unemployed.

- Report any income accurately.

- Be physically able to work and available for suitable employment.

- Actively look for new work opportunities.

Failure to meet these requirements may delay or stop your benefits.

When to File for Unemployment

You should file your claim as soon as you lose your job or your work hours are reduced. Delaying your claim can reduce your benefits. Claims can be filed online through the EDD UI Online portal, which is the fastest and most convenient option.

How Taxes Affect Your Benefits

Unemployment benefits are considered taxable income under federal law, though California does not tax UI benefits. You can choose to have federal taxes withheld automatically from your weekly payments to avoid a large tax bill later.

How to Appeal a Denied Claim

If your claim is denied, you have the right to file an appeal within 20 days of the mailing date of the decision. You’ll need to submit a written appeal and may have to attend a hearing.

Many denials are overturned when claimants provide additional documentation or clarification.

How Unemployment Interacts with Other Benefits

Unemployment benefits are separate from disability or paid family leave programs. However, you can’t receive multiple benefits for the same period. If you recently claimed disability benefits, your unemployment eligibility may begin only after that period ends.

Internal Relation with Other California Calculations

Just like you calculate property or sales taxes based on income and value, unemployment benefits also depend on your earnings record. If you’re budgeting for the year, you might also check related topics like How to Calculate California State Tax Withholding to better manage your income once you’re re-employed.

Tips to Maximize Your Unemployment Benefits

- File your claim immediately after job loss.

- Double-check your wage records for accuracy.

- Keep weekly job search logs ready for EDD review.

- Sign up for direct deposit to receive payments faster.

- Continue applying for suitable jobs to maintain eligibility.