Understanding how to calculate California state tax withholding is crucial for every employee and employer. Withholding is the portion of your paycheck your employer deducts to cover your state income taxes. If too little is withheld, you’ll owe taxes at year-end; too much, and you’ve given the state an interest-free loan. Let’s break down how the calculation works in 2025 and how you can estimate your correct withholding.

What Is State Tax Withholding?

State tax withholding is the amount your employer deducts from each paycheck based on your expected annual income and filing status. It’s sent directly to the California Franchise Tax Board (FTB). The goal is to match your total withholding with your actual tax liability by the end of the year.

Components That Affect Withholding

Several factors influence how much state income tax is withheld in California:

- Gross income (total pay before deductions)

- Filing status (single, married, head of household)

- Allowances/Dependents (based on your DE-4 form)

- Additional withholdings you request

- Pre-tax deductions like retirement or health insurance contributions

Each of these affects how your taxable income is calculated, and therefore, your final withholding amount.

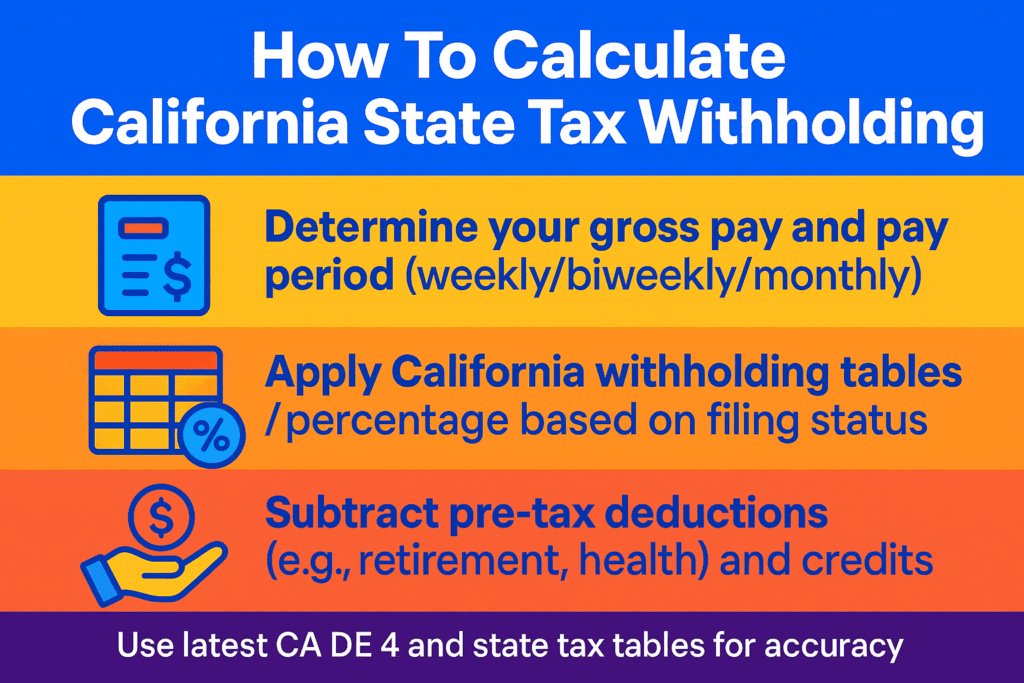

Step-by-Step: How To Calculate California Withholding

- Determine your gross pay: For example, let’s say you earn $5,000 per month.

- Subtract pre-tax deductions: Suppose $400 goes into retirement and $200 into health insurance. Your taxable pay is now $4,400.

- Identify your filing status and allowances: Based on your DE-4 (California equivalent of W-4), you claim certain allowances that reduce taxable income.

- Find your tax rate using the FTB tables: For 2025, California’s personal income tax rates range from 1% to 12.3%, depending on income level.

- Apply the appropriate rate: If your annual income is $60,000 and you’re single, your marginal rate might be around 8%.

- Calculate withholding: $4,400 × 8% = $352 withheld for that month.

This is a simplified version; actual withholding uses tiered brackets and standard deductions.

Example Using Annual Income

Let’s say you’re single with no dependents earning $72,000 annually. Based on FTB’s 2025 tables:

- The first $10,000 is taxed at 1%

- The next $20,000 at 2%

- The next $20,000 at 4%

- Remaining $22,000 at 6%

Your total state tax ≈ $2,780 annually → about $231 per month withheld.

California Withholding Tax Brackets (2025 Simplified)

| Taxable Income (Single) | Tax Rate |

|---|---|

| Up to $10,000 | 1% |

| $10,001 – $25,000 | 2% |

| $25,001 – $40,000 | 4% |

| $40,001 – $60,000 | 6% |

| $60,001 – $300,000 | 8% |

| Over $300,000 | 9.3–12.3% |

These rates include both the base and mental health surcharge (for high-income earners).

How To Adjust Your Withholding

If you find that too much or too little is being withheld, you can file a new DE-4 form with your employer. You can also:

- Add an extra flat amount per paycheck

- Change your filing status or number of allowances

- Use the FTB Withholding Calculator to estimate accurate figures

Common Mistakes Employees Make

- Forgetting to update their DE-4 after marriage, divorce, or a second job

- Claiming too many allowances and under-withholding

- Ignoring bonuses and overtime that push them into a higher tax bracket

Keeping your DE-4 updated prevents tax surprises in April.

Employer Responsibilities

Employers must calculate and remit state tax withholding regularly to the FTB. They also issue Form W-2 annually showing total income and withheld taxes. Failure to remit or file accurately can result in penalties and interest.

Related Reading (Internal Link)

Want to know how California’s overall tax system affects your paycheck? Read our guide: What Is California Sales Tax Rate